Quick Hits

- Pennsylvania’s high court ruled that Pittsburgh’s 3 percent tax on nonresident athletes, known as the “Jock Tax,” was unconstitutional due to its violation of the state constitution’s Uniformity Clause, which requires taxpayers to be treated similarly.

- The court found that the tax created an unfair burden on nonresident athletes compared to resident athletes without a valid justification, violating the state’s constitutional requirement for uniformity of taxation.

- This ruling could influence rulings on similar tax provisions in other states, as many have comparable uniformity provisions in their constitutions.

The Pennsylvania high court sided with a group of professional athletes and their unions, ruling that Pittsburgh’s “Jock Tax” was unconstitutional under the Uniformity Clause of the Pennsylvania Constitution because it imposed an unequal tax burden on nonresidents without a concrete justification.

Nonresident State Income Tax Withholding for Athletes and Entertainers

Athletes and entertainers are subject to income tax in each state where they perform or earn income, even if they do not reside in those states. States impose income tax on the portion of income earned while physically present, working, or performing in that state. This means the athlete or entertainer must file nonresident state income tax returns in each state where income is generated, which can result in multiple state tax filings and potential complexity.

States typically tax nonresident athletes and entertainers based on their “duty days,” a calculation that considers only the days they perform or play a game. This duty-day calculation can result in more of an athlete’s or entertainer’s taxable income being sourced to a nonresident state because a greater percentage of the athlete’s or entertainer’s income is earned on a per-game or per-performance basis as opposed to a calculation based on all potential workdays in a year, as is done for a typical nonresident worker.

In addition, some local jurisdictions, such as the City of Pittsburgh, have imposed similar duty day–based taxes (often called “Jock Taxes” because they impact professional athletes) on athletes and entertainers when they play or perform in those jurisdictions. Such taxes, while providing additional revenue for local municipalities, have a significant impact on athletes and performers, increasing their tax burden, complicating their tax compliance, and affecting their contracts and where they choose to live.

Pittsburgh’s ‘Jock Tax’

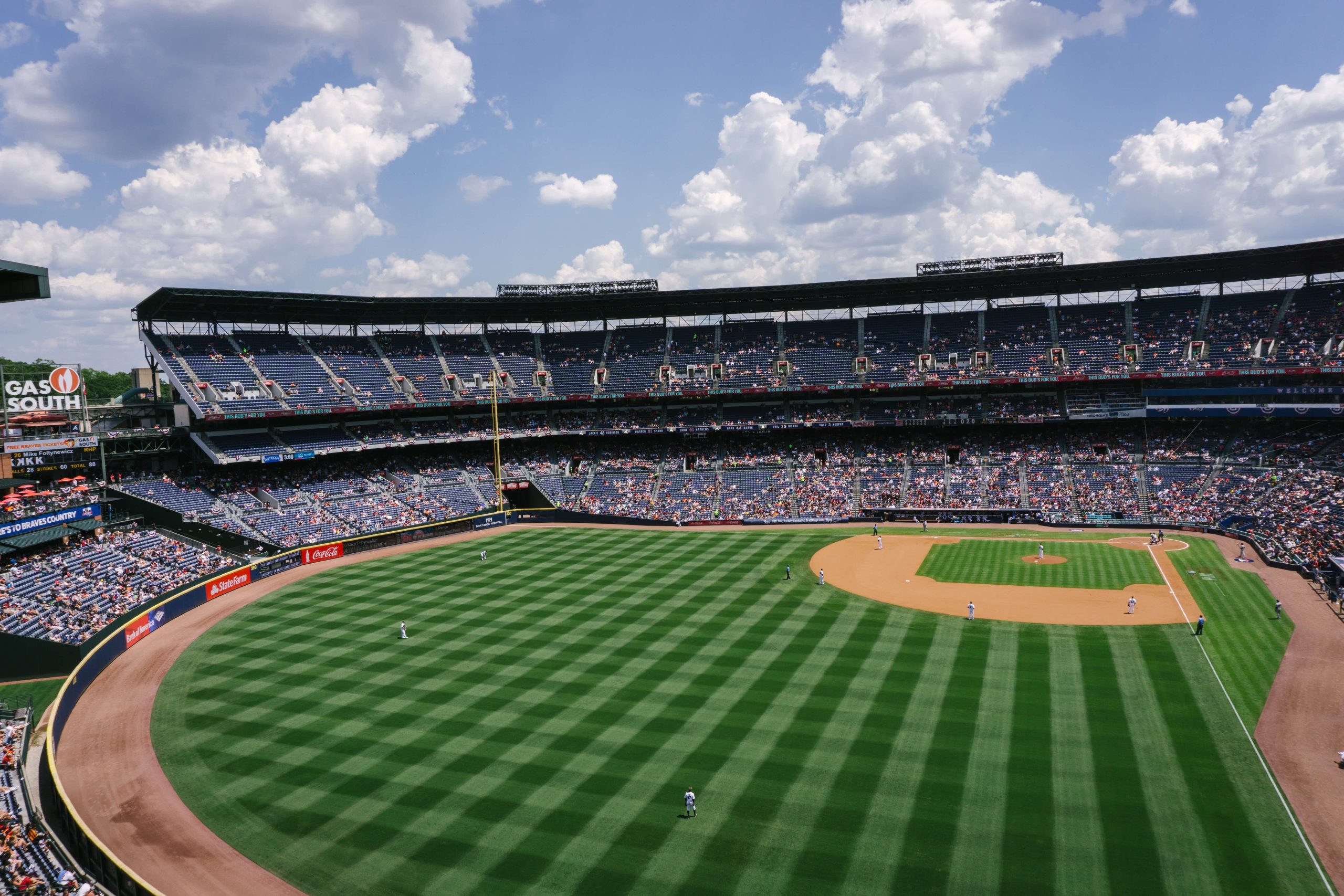

The City of Pittsburgh enacted the Nonresident Sports Facility Usage Fee under the Local Tax Enabling Act (LTEA), which allows cities with publicly funded sports stadiums to impose fees on nonresident individuals who use such facilities for athletic events or performances. Pittsburgh’s facility usage fee was set at 3 percent of the income earned at the stadiums, while Pittsburgh residents were subject to a 1 percent earned income tax and a 2 percent school district tax.

A group of professional baseball, football, and hockey athletes and their unions alleged that the tax was unconstitutional because it unlawfully discriminated between resident and nonresident athletes and performers.

The Supreme Court of Pennsylvania noted that while the tax was expected to pay for Pittsburgh’s three publicly funded professional sports stadiums, the state legislature had allowed such taxes to help relieve the city’s fiscal stress.

‘Jock Tax’ Lacks Uniformity

The Supreme Court of Pennsylvania affirmed two lower courts’ decisions, holding that Pittsburgh’s facility tax was unconstitutional under the Uniformity Clause. In summary, the court found that Pittsburgh’s “Jock Tax” unfairly discriminated against nonresidents by imposing a higher tax burden on them compared to residents, and therefore, was unconstitutional.

Despite the 2 percent disparity between resident and nonresident athletes, the city argued that the tax treated both groups equally since residents paid an additional 2 percent school district tax, meaning that both residents and nonresidents had effectively the same tax burden.

However, the Pennsylvania high court said that the school tax was not relevant since it, by its nature, only applies to residents and found that Pittsburgh did not provide a legitimate distinction to justify the disparate treatment of resident and nonresident athletes and entertainers.

“Because the two percent Pittsburgh School District tax cannot be used to justify the facility fee in our Uniformity Clause analysis, and because the City of Pittsburgh has not supplied a ‘concrete justification’ for treating resident athletes and entertainers differently from nonresident athletes and entertainers, we agree with the lower courts that the facility fee is unconstitutional,” the Pennsylvania high court unanimously ruled.

Next Steps

Pittsburgh’s facility usage fee is one of many “Jock Taxes” that have been enacted by municipalities across the country to collect tax revenue from athletes and entertainers who play games or perform in the municipalities for short periods of time. The Supreme Court of Pennsylvania’s ruling is significant since most state constitutions have constitutional requirements for uniformity similar to Pennsylvania’s, meaning the decision could be persuasive on courts in other states and spur further challenges to “Jock Taxes” across the country.

Ogletree Deakins’ Employment Tax Practice Group will continue to monitor developments and will provide updates on the Employment Tax, Pennsylvania, and Sports and Entertainment blogs as additional information becomes available.

Follow and Subscribe

LinkedIn | Instagram | Webinars | Podcasts