Please note the following:

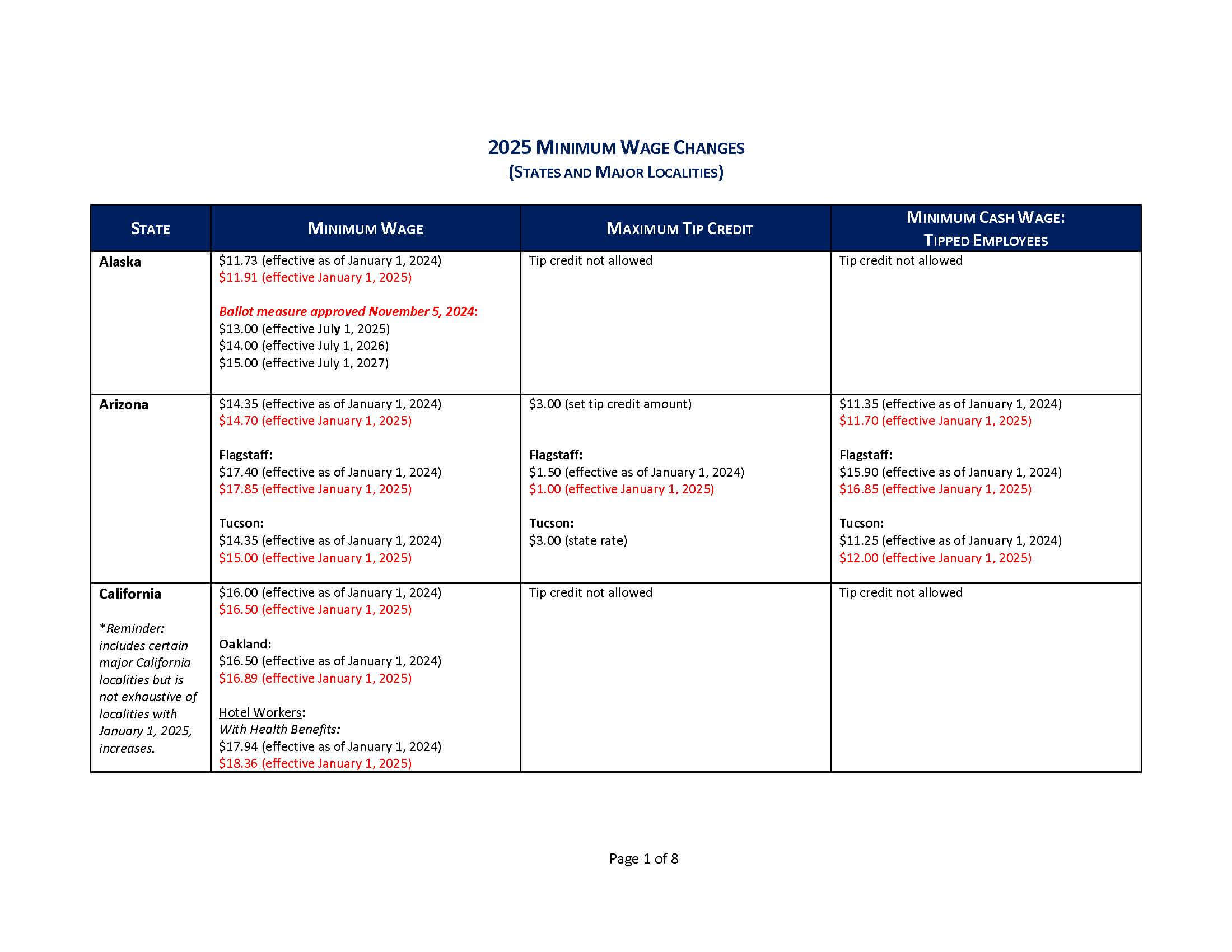

- Recent minimum wage developments—including those noted below in Michigan, Alaska, and Missouri—and all upcoming January 1, 2025, rates are shown in red text.

-

- Michigan Minimum Wage: Michigan’s minimum wage will increase twice in 2025: first on January 1, 2025 (following the usual annual increase schedule), and again on February 21, 2025, in accordance with the July 2024 Michigan Supreme Court decision in Mothering Justice v. Attorney General. These rates are noted in the Michigan section below.

- Ballot Initiatives: On November 5, 2024, voters in Alaska and Missouri approved minimum wage ballot initiatives to increase the minimum wage rate in those states. These new scheduled increases begin on January 1, 2025, in Missouri and July 1, 2025, in Alaska, as noted in the chart. (Alaska’s minimum wage also will increase on January 1, 2025, in accordance with the usual rate adjustment schedule.)

- The chart below includes major localities with their own minimum wage rates that will increase in 2025. It is not exhaustive of all localities nationwide that may have a minimum wage different from the applicable state or federal rate.

- Jurisdictions that will not have—or have not announced—2025 increases in their minimum wage rates generally are not included in the chart below.

- The federal minimum wage rate remains at $7.25 per hour for nontipped employees and $2.13 per hour for tipped employees (with a maximum tip credit of $5.12).

To expand and explore the full chart, please click the thumbnail below.

The Ogletree Deakins Client Portal provides subscribers with timely updates on wage and hour laws, including minimum wage and tip credit requirements. Our updated Minimum Wage and Minimum Wage Tip Credit state law maps and law summaries cover state and major locality current minimum wage and tip credit rates, new rates going into effect on January 1, 2025 (as reflected in the above table), and other future minimum wage and tip credit rates that states and major localities have published or announced. (Full law summaries are available for Premium-level subscribers; Snapshots and Updates are available for all registered client users.) For more information on the Client Portal or a Client Portal subscription, please reach out to clientportal@ogletree.com.

Ogletree Deakins’ Wage and Hour Practice Group will continue to monitor developments and will provide updates on the State Developments and Wage and Hour blogs as additional information becomes available.

Follow and Subscribe