Several state and local minimum wage rates will increase in 2023, with a majority of the changes effective on January 1, 2023. The chart below lists state and certain major locality minimum wage increases for 2023—and future years, if available—along with the related changes in the maximum tip credit and minimum cash wage for tipped employees.

Please note the following:

- Minimum wage rates that will take effect on January 1, 2023 (or December 31, 2022, in New York) are in bold text.

- The chart includes major localities with their own minimum wage rates that will increase in 2023. It is not exhaustive of every locality nationwide that may have a minimum wage rate different from the applicable state or federal rate.

- “Current” indicates that the rate is current as of the publication date of this article.

- Jurisdictions that will not have—or have not announced—2023 increases in their minimum wage rates generally are not included in the chart below.

- The federal minimum wage rate will remain at $7.25 per hour for non-tipped employees and $2.13 per hour for tipped employees.

- District of Columbia, Nebraska, and Nevada minimum wage rate and/or tip credit changes are based on ballot measures approved by voters on November 8, 2022, and are noted in red text.

Additional information on state and local minimum wage rates is available in the firm’s OD Comply: State Wage & Hour subscription materials, which are updated and provided to OD Comply subscribers as the law changes.

2023 Minimum Wage Increases

(State and Major Locality)

| State | Minimum Wage | Maximum Tip Credit | Minimum Cash Wage: Tipped Employees |

| Alaska | $10.34 (current) $10.85 (effective January 1, 2023) |

Tip credit not allowed | Tip credit not allowed |

| Arizona | $12.80 (current) $13.85 (effective January 1, 2023)Flagstaff: $15.50 (current) $16.80 (effective January 1, 2023)Tucson: $13.00 (current) $13.85 (effective January 1, 2023)* $14.25 (effective January 1, 2024) $15.00 (effective January 1, 2025) Adjusted annually thereafter*Originally scheduled to increase to $13.50, but raised to $13.85 due to state rate increase, as announced by the City of Tucson. |

$3.00 (current) (set tip credit amount)Flagstaff: $2.50 (current) $2.00 (effective January 1, 2023) Tucson: |

$9.80 (current) $10.85 (effective January 1, 2023)Flagstaff: $13.00 (current) $14.80 (effective January 1, 2023)Tucson: $10.00 (current) $10.85 (effective January 1, 2023) $11.25 (effective January 1, 2024) $12.00 (effective January 1, 2025) |

| California*Note: includes several major California localities but is not exhaustive. | Employers with 26 or more employees: $15.00 (current) $15.50 (effective January 1, 2023)Employers with 25 or fewer employees: $14.00 (current) $15.50 (effective January 1, 2023)Oakland: $15.06 (current) $15.97 (effective January 1, 2023)San Diego: $15.00 (current) $16.30 (effective January 1, 2023)San Jose: $16.20 (current) $17.00 (effective January 1, 2023) West Hollywood: Employers with 49 or fewer employees: Hotel Employers (as defined): |

Tip credit not allowed | Tip credit not allowed |

| Colorado | $12.56 (current) $13.65 (effective January 1, 2023)Denver: $15.87 (current) $17.29 (effective January 1, 2023) |

$3.02 (current) (no change)Denver: $3.02 (current) (state rate) |

$9.54 (current) $10.63 (effective January 1, 2023)Denver: $12.85 (current) $14.27 (effective January 1, 2023) |

| Connecticut | $14.00 (current) $15.00 (effective June 1, 2023) |

Tipped service employees other than bartenders: $7.62 (current) $8.62 (effective June 1, 2023)Bartenders: $5.77 (current) $6.77 (effective June 1, 2023) |

Tipped service employees other than bartenders: $6.38 (current) (set cash wage amount)Bartenders: $8.23 (current) (set cash wage amount) |

| Delaware | $10.50 (current) $11.75 (effective January 1, 2023) $13.25 (effective January 1, 2024) $15.00 (effective January 1, 2025) |

$8.27 (current) $9.52 (effective January 1, 2023) $11.02 (effective January 1, 2024) $12.77 (effective January 1, 2025) |

$2.23 (current) (set cash wage amount) |

| District of Columbia | $16.10 (current)To be determined (effective July 1, 2023) | $10.75 (current) $10.10 (effective January 1, 2023)**Tip credit will decrease incrementally and phase out by 2027 pursuant to minimum cash wage increases approved in November 8, 2022, ballot measure. |

$5.35 (current)Ballot measure approved on November 8, 2022:

$6.00 (effective May 1, 2023) Equal to minimum wage for non-tipped workers (effective July 1, 2027) |

| Florida | $11.00 (current) $12.00 (effective September 30, 2023) $13.00 (effective September 30, 2024) $14.00 (effective September 30, 2025) $15.00 (effective September 30, 2026) |

$3.02 (current) (no change) | $7.98 (current) $8.98 (effective September 30, 2023) $9.98 (effective September 30, 2024) $10.98 (effective September 30, 2025) $11.98 (effective September 30, 2026) |

| Hawaii | $12.00 (current) $14.00 (effective January 1, 2024) $16.00 (effective January 1, 2026) $18.00 (effective January 1, 2028) |

$1.00 (current) $1.25 (effective January 1, 2024) $1.50 (effective January 1, 2028) |

$11.00 (current) $12.75 (effective January 1, 2024) $16.50 (effective January 1, 2028) |

| Illinois | $12.00 (current) $13.00 (effective January 1, 2023) $14.00 (effective January 1, 2024) $15.00 (effective January 1, 2025)Chicago: Employers with 21 or more total employees: $15.40 (current) (no change)Employers with 4–20 total employees: $14.50 (current) $15.00 (effective July 1, 2023)Cook County: $13.35 (current) (no change January 2023) |

$4.80 (current) $5.20 (effective January 1, 2023) $5.60 (effective January 1, 2024) $6.00 (effective January 1, 2025)Chicago: Employers with 21 or more total employees: $6.16 (current) (no change)Employers with 4–20 total employees: $5.80 (current) $6.00 (effective July 1, 2023)Cook County: $5.95 (current) $5.55 (effective January 1, 2023) |

$7.20 (current) $7.80 (effective January 1, 2023) $8.40 (effective January 1, 2024) $9.00 (effective January 1, 2025)Chicago: Employers with 21 or more total employees: $9.24 (current) (no change)Employers with 4–20 total employees: $8.70 (current) $9.00 (effective July 1, 2023)Cook County: $7.40 (current) $7.80 (state rate) (effective January 1, 2023) |

| Maine | $12.75 (current) $13.80 (effective January 1, 2023)Portland: $13.00 (current) $14.00 (effective January 1, 2023) $15.00 (effective January 1, 2024) |

$6.37 (current) $6.90 (effective January 1, 2023)Portland: $6.50 (current) $7.00 (effective January 1, 2023) $7.50 (effective January 1, 2024) |

$6.38 (current) $6.90 (effective January 1, 2023)Portland: $6.50 (current) $7.00 (effective January 1, 2023) $7.50 (effective January 1, 2024) |

| Maryland | Employers with 15 or more employees: $12.50 (current) $13.25 (effective January 1, 2023) $14.00 (effective January 1, 2024) $15.00 (effective January 1, 2025)“Small Employers” with 14 or fewer employees: $12.20 (current) $12.80 (effective January 1, 2023) $13.40 (effective January 1, 2024) $14.00 (effective January 1, 2025) $14.60 (effective January 1, 2026) $15.00 (effective July 1, 2026)Montgomery County: Employers with 51 or more employees: $15.65 (current)Employers with 11–50 employees: $14.50 (current) $15.00 (effective July 1, 2023)Employers with 10 or fewer employees: $14.00 (current) $14.50 (effective July 1, 2023) $15.00 (effective July 1, 2024) |

Employers with 15 or more employees: $8.87 (current) $9.62 (effective January 1, 2023) $10.37 (effective January 1, 2024) $11.37 (effective January 1, 2025)“Small Employers” with 14 or fewer employees: $8.57 (current) $9.17 (effective January 1, 2023) $9.77 (effective January 1, 2024) $10.37 (effective January 1, 2025) $10.97 (effective January 1, 2026) $11.37 (effective July 1, 2026)Montgomery County: Employers with 51 or more employees: $11.65 (current)Employers with 11–50 employees: $10.50 (current) $11.00 (effective July 1, 2023)Employers with 10 or fewer employees: $10.00 (current) $10.50 (effective July 1, 2023) $11.00 (effective July 1, 2024) |

$3.63 (current) (set cash wage amount)Montgomery County: $4.00 (current) (no change) |

| Massachusetts | $14.25 (current) $15.00 (effective January 1, 2023) |

$8.10 (current) $8.25 (effective January 1, 2023) |

$6.15 (current) $6.75 (effective January 1, 2023) |

| Michigan | $9.87 (current) $10.10 (effective January 1, 2023)**Pending future action on stay of July 2022 Michigan Court of Claims’ reinstatement of 2018 voter-initiated state minimum wage law (in place until February 19, 2023) |

$6.12 (current) $6.26 (effective January 1, 2023)* |

$3.75 (current) $3.84 (effective January 1, 2023)* |

| Minnesota | Large Employers (annual gross revenues of $500,000 or more): $10.33 (current) $10.59 (effective January 1, 2023)Small Employers (annual gross revenues of less than $500,000): $8.42 (current) $8.63 (effective January 1, 2023)Minneapolis: Large Employers (more than 100 total employees): $15.00 (current) $15.19 (effective January 1, 2023)*Small Employers (100 or fewer total employees): $13.50 (current) $14.50 (effective July 1, 2023) $15.19 (effective July 1, 2024)**Will increase to account for inflation every subsequent January 1. St. Paul: Large Businesses (101–10,000 total employees): Small Businesses (6–100 total employees): Micro Businesses (5 or fewer employees): |

Tip credit not allowed | Tip credit not allowed |

| Missouri | $11.15 (current) $12.00 (effective January 1, 2023) |

$5.57 (current) $6.00 (effective January 1, 2023) |

$5.58 (current) $6.00 (effective January 1, 2023) |

| Montana | $9.20 (current) $9.95 (effective January 1, 2023) |

Tip credit not allowed | Tip credit not allowed |

| Nebraska | $9.00 (current)Ballot measure approved on November 8, 2022: $10.50 (effective January 1, 2023) $12.00 (effective January 1, 2024) $13.50 (effective January 1, 2025) $15.00 (effective January 1, 2026) |

$6.87 (current)Based on ballot-measure approved minimum wage increases: $8.37 (effective January 1, 2023) $9.87 (effective January 1, 2024) $11.37 (effective January 1, 2025) $12.87 (effective January 1, 2026) |

$2.13 (current) (set cash wage amount) |

| Nevada | Employers offering qualified health insurance benefits: $9.50 (current) $10.25 (effective July 1, 2023) $12.00 (effective July 1, 2024)*Employers that do not offer qualified health insurance benefits: $10.50 (current) $11.25 (effective July 1, 2023) $12.00 (effective July 1, 2024)*Ballot measure approved on November 8, 2022, changes this 2024 rate from $11.00 (as previously scheduled) to $12.00. |

Tip credit not allowed | Tip credit not allowed |

| New Jersey | Employers with 6 or more employees: $13.00 (current) $14.13 (effective January 1, 2023) $15.13 (effective January 1, 2024)Employers with 5 or fewer employees and seasonal employers: $11.90 (current) $12.93 (effective January 1, 2023) $13.73 (effective January 1, 2024) $14.53 (effective January 1, 2025) $15.23 (effective January 1, 2026) |

Employers with 6 or more employees: $7.87 (current) $8.87 (effective January 1, 2023) $9.87 (effective January 1, 2024)Employers with 5 or fewer employees and seasonal employers: $6.77 (current) $7.57 (effective January 1, 2023) $8.37 (effective January 1, 2024) |

$5.13 (current) $5.26 (effective January 1, 2023) $5.26 (effective January 1, 2024) |

| New Mexico | $11.50 (current) $12.00 (effective January 1, 2023)Albuquerque (city): $11.50 (current) $12.00 (effective January 1, 2023)**Originally announced as $12.50. The City of Albuquerque has now changed this rate to $12.00.Santa Fe (city): $12.95 (current) (no change) |

$8.70 (current) $9.00 (effective January 1, 2023)Albuquerque (city): $3.60 (current) $4.80 (effective January 1, 2023)Santa Fe (city): $10.15 (current) $9.95 (effective January 1, 2023) |

$2.80 (current) $3.00 (effective January 1, 2023)Albuquerque (city): $6.90 (current) $7.20 (effective January 1, 2023)**Originally announced as $7.50. The City of Albuquerque has now changed this rate to $7.20.Santa Fe (city): $2.80 (current) $3.00 (state rate) (effective January 1, 2023) |

| New York | Statewide—Upstate (outside NYC and Westchester/Nassau/Suffolk counties): $13.20 (current) $14.20 (effective December 31, 2022)New York State Department of Labor (NYSDOL) Minimum Wage Guidance |

Statewide–Upstate (outside NYC and Westchester/Nassau/Suffolk counties): Tipped service employees:* $2.20 (current) $2.35 (effective December 31, 2022)Tipped food service workers:* $4.40 (current) $4.75 (effective December 31, 2022)*Applies in hospitality industry. See NYSDOL guidance (“Minimum Wage for Tipped Workers”): As of December 31, 2020, a tip credit is not permitted in miscellaneous industries. |

Statewide—Upstate (outside NYC and Westchester/Nassau/Suffolk Counties): Tipped service employees:* $11.00 (current) $11.85 (effective December 31, 2022)Tipped food service workers:* $8.80 (current) $9.45 (effective December 31, 2022)*Applies in hospitality industry. See NYSDOL guidance (“Minimum Wage for Tipped Workers”): As of December 31, 2020, a tip credit is not permitted in miscellaneous industries. |

| Ohio | $9.30 (current) $10.10 (effective January 1, 2023)Small Employers (annual gross receipts of less than $342,000* per year): $7.25 (current)*Small employer threshold increases to $371,000, effective January 1, 2023 |

$4.65 (current) $5.05 (effective January 1, 2023) |

$4.65 (current) $5.05 (effective January 1, 2023) |

| Rhode Island | $12.25 (current) $13.00 (effective January 1, 2023) $14.00 (effective January 1, 2024) $15.00 (effective January 1, 2025) |

$8.36 (current) $9.11 (effective January 1, 2023) $10.11 (effective January 1, 2024) $11.11 (effective January 1, 2025) |

$3.89 (current) (no change) |

| South Dakota | $9.95 (current) $10.80 (effective January 1, 2023) |

$4.97 (current) $5.40 (effective January 1, 2023) |

$4.98 (current) $5.40 (effective January 1, 2023) |

| Vermont | $12.55 (current) $13.18 (effective January 1, 2023) |

$6.27 (current) $6.59 (effective January 1, 2023) |

$6.28 (current) $6.59 (effective January 1, 2023) |

| Virginia | $11.00 (current) $12.00 (effective January 1, 2023) $13.50 (effective January 1, 2025)* $15.00 (effective January 1, 2026)**If reenacted by General Assembly before July 1, 2024. |

$8.87 (current) $9.87 (effective January 1, 2023) |

$2.13 (current) (no change) |

| Washington | $14.49 (current) $15.74 (effective January 1, 2023)Seattle: Large Employers (more than 500 employees worldwide), regardless of payments toward an employee’s medical benefits: $17.27 (current) $18.69 (effective January 1, 2023)Small Employers (500 or fewer employees worldwide) who do not contribute at least $1.52* per hour toward an individual employee’s medical benefits or in tips: $17.27 (current) $18.69 (effective January 1, 2023) Small Employers (500 or fewer employees worldwide) who do pay at least $1.52* per hour toward an individual employee’s medical benefits or in tips: $15.75 (current) $16.50 (effective January 1, 2023)*This benefits/tip threshold increases to $2.19, effective January 1, 2023. |

Tip credit not allowed | Tip credit not allowed |

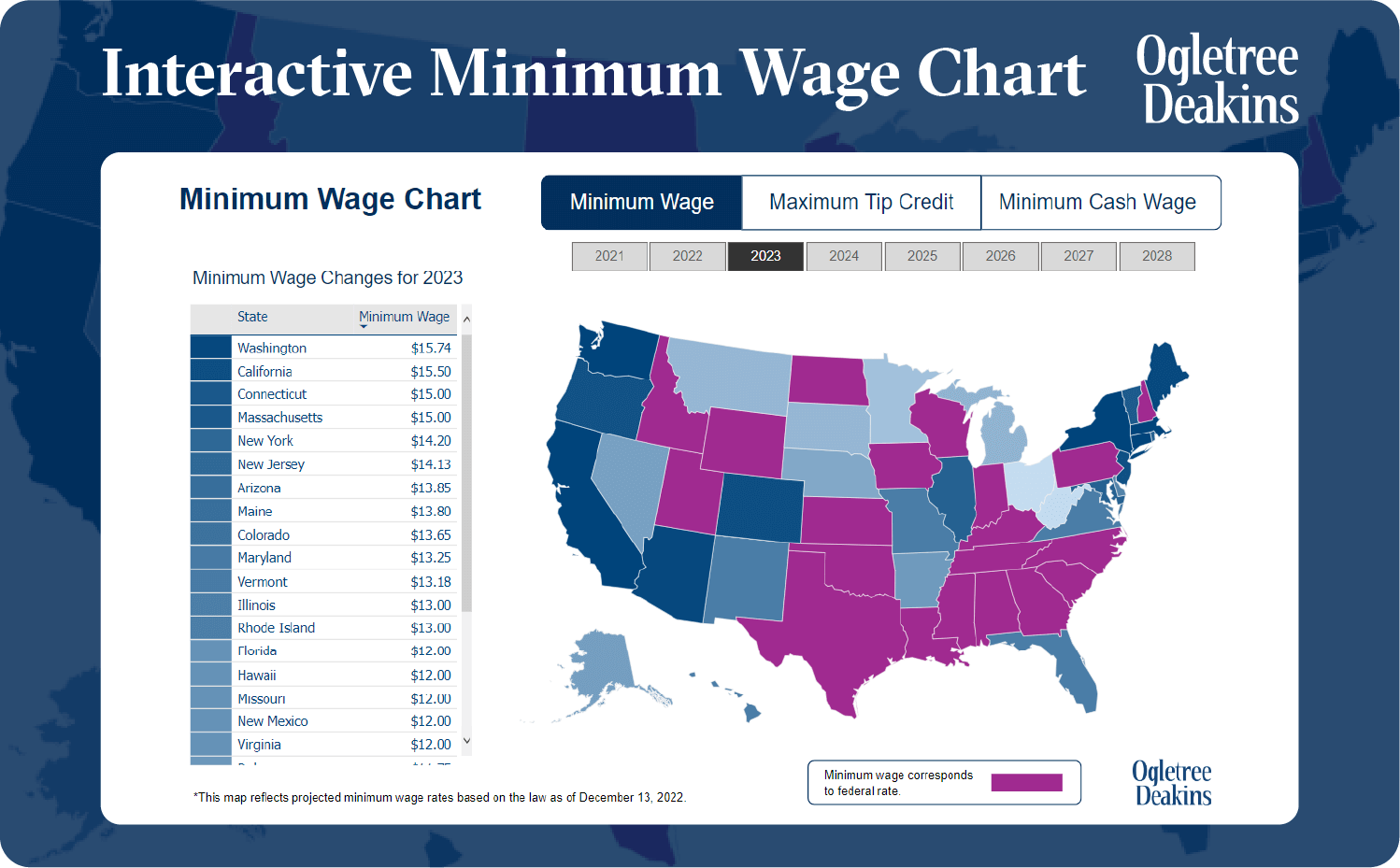

In addition to the above chart, employers may find the interactive map helpful in preparing for these wage and hour changes in the new year and in coming years. The map provides the minimum wage rate and applicable tip credits—in addition to employers’ minimum cash wage obligations—through 2028 for each state and the District of Columbia.